Authored by: Manasa Visakai, Content Producer

Expert Input: Lorna Reid, Workplace Relations Advisor

Australian businesses are to stay vigilant as new workplace legislation updates come through. How to ensure compliance?

As a new wave of workplace legislation updates start to come into effect, Australian businesses must stay vigilant. Employers and HR teams need to ensure that they are not only informing themselves, but also their employees on how these changes impact their employment conditions. Besides the upcoming changes, employers also need to stay on top of updates that occur annually.

We spoke to our Workplace Relations Advisor, Lorna Reid, about these workplace changes and sought her advice on how employers can remain compliant.

Lorna addresses the ‘what next’ question for each piece of legislation to further elaborate and assist employers/managers.

Important workplace relations changes we cover

Relating to the Closing Loopholes Legislation

- Right to Disconnect legislation

- New changes to casual employment

Annual updates that you should be aware of

- Unfair dismissal threshold

- Changes to superannuation

What is the Right to Disconnect?

The Right to Disconnect grants employees the right to ignore contact from their employer or a third party in relation to work outside of their regular working hours if the contact is unreasonable. However, an employee cannot exercise this right if a contact from the employer is reasonable.

Introduced in the Fair Work Legislation Amendment (Closing Loopholes No. 2) Act 2024 (Cth), the changes are to take effect from 26 August 2024 for medium to large scale businesses, and a year later for small businesses (less than 15 employees).

The Right to Disconnect will be explicitly recognised as a protected right under the Fair Work Act 2009 (Cth) (‘FW Act’) where an employee can refuse to monitor, read, or respond to contact or ‘attempted’ contact from their employer.

The employees’ right to disconnect may be deemed ‘unreasonable’, taking into consideration a non-exhaustive list of matters, including:

- the reason for contact or attempted contact activity

- the extent to which the employee is compensated to remain available to carry on their duties or for engaging in additional hours of work outside of their ordinary hours

- the nature of the employee’s role and their level of responsibility

- the employee’s personal circumstances (including family or caring responsibilities)

Q: What employers need to know and action with the new ‘right to disconnect’

Lorna responds:

“The best thing that employers can do to assist with managing the new right to disconnect is:

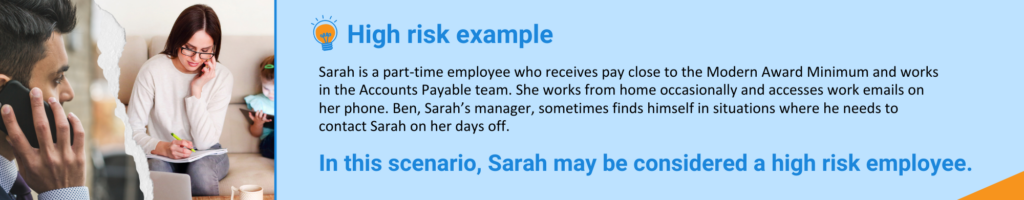

- Perform a risk assessment identifying key employees who may be unreasonably contacted outside of their working hours. This can be done by categorising your employees into low, medium, and high-risk categories.

Here is one example of how an employer can identify employees who fall into one of the above categories.

In such situations, it is essential to assess the individual circumstances and discuss with the employee about their availability, outside of their regular work hours. With regards to high-risk employees, employers can implement measures to reduce the risk of unreasonably contacting these employees outside of working hours. Employers can facilitate a discussion to address any of concerns in this context.

- Educate all leaders and employees alike on the right to disconnect, which will include defining reasonable contact, which can be demonstrated through relatable examples.

- Implement a policy that defines the Right to Disconnect, the criteria on assessing ‘reasonable contact’, and notifies employees of an internal dispute resolution pathway.

- Assess your workforce and the types of communication channels that may now impose a risk to the company due to this new right. Employers may decide to re-educate employees on how to use communication platforms to ensure they are not unreasonably contacting employees outside of work hours.”

Q: What are the exceptions to the right to disconnect?

Lorna responds:

“The right to disconnect will not apply where the refusal from the employee is considered ‘unreasonable’.

Assessing whether contact is reasonable or unreasonable will be based on individual circumstances and will consider several factors that have been outlined above.”

Casual employment changes

On 26 August 2024, there will be changes to employment laws as part of the Closing Loopholes reform, which also covers engaging casual employees – how casual work is defined, an ‘Employee Choice’ pathway to convert to a full-time or part-time employee, and the employer-employee responsibilities to adhere to.

The new definition, introduced into the FW Act, underlines two key aspects to casual employment:

- It is not characterised by a firm advanced commitment to continuing and indefinite work. This considers a number of factors.

- The employee is entitled to a casual loading, or specific casual rate of pay, under their industrial instrument.

Q: Navigating major changes in casual employment

Lorna responds:

“This is a good time for employers to have a look at all their casual arrangements and review the last 6-12 months of work patterns for their casual employees. If you have a casual that is working regular and systematic hours, you could expect a request for casual conversion.

Depending on how your contracts are currently structured, you may also need to update your casual contracts to ensure they are in-line with the legislation.

Furthermore, it is very important that you are on top of responding to requests for the casual conversion. You have 21 days to consult with the employee and respond to the request, so make sure that your managers and team leader are aware of what to do if they receive a request from their employee.

It may be best to have your HR person deal with all the requests or assist with dealing with the requests. The assigned HR person can then liaise with the manager or team leader in consulting and responding.

Do not forget that there are also some changes to the timing for when the Casual Employment Information Statement (‘CEIS’) needs to be sent to your employees. For businesses with 15 or more employees, they need to provide a copy of the CEIS to their employees at:

- Commencement

- After six months

- After 12 months

- Every 12 months thereafter

For small businesses (less than 15 employees) it is just at commencement and after the employee reaches 12 months. If you have a HRIS in place, I suggest automating this process to make it easier for you.”

Q: How changes to the FW Act will affect casual employment

Lorna responds:

“When assessing whether an employee is a casual or not, the assessment will be returning to the method of assessing the practical reality and true nature of the employment relationship.

Previously the relationship would be defined as casual if the employee had accepted a casual contract from an employer knowing that there is no firm advance commitment to continuing and indefinite work. We have now returned to a position where the relationship after the contract has been entered into will also be considered.”

Increase to the High Income Threshold for unfair dismissal claims

What Is the Unfair Dismissal High-Income Threshold?

It is important to take note that the threshold increase occurs annually and is not part of the new wave of changes.

The high-income threshold is a monetary cap determined by the Fair Work Commission to gauge the eligibility of an employee to be protected from unfair dismissal and therefore make an unfair dismissal claim to the Fair Work Commission. If an employee’s earnings exceed this ‘threshold’, they cannot pursue an unfair dismissal claim under the terms of the FW Act.

As of 1 July 2024, the high-income threshold was increased to $175,000. The Fair Work Commission will review and adjust this threshold annually on 1 July. The Fair Work Commission notes that for dismissals that occurred on or before June 30, 2024, the threshold remains at $167,500.

Components of the threshold:

- Included are earnings such as base salary, guaranteed bonuses, and fringe benefits

- Excluded are superannuation, discretionary bonuses, and reimbursements

Q: What are the implications for employers and employees?

Lorna responds:

“When undergoing a termination process, it is essential for employers to ensure that they adhere to a procedurally fair process. The consideration of the high-income threshold becomes particularly significant when conducting a risk analysis related to an employee termination.

For employees, the biggest implication is the enhanced protection for those that, last year, may have been over the threshold, and now due to the adjustment may be protected by unfair dismissal.”

Q: Any exceptions and considerations to keep in mind?

Lorna responds:

“The high-income threshold is not as straightforward to apply as some may think. You need to consider all the specific circumstances as well as reviewing the income of the employee.

- The high-income threshold does not apply to employees covered by an enterprise agreement. EBA covered employees can earn above the high-income threshold and still be within the jurisdiction of the Fair Work Commission.

- If an employee earns above the high-income threshold and is covered by a modern award, they still can pursue an unfair dismissal application.

- The high-income threshold does not apply to general protections claims.

My advice to anyone that is relying on this high-income threshold during a risk analysis, is to seek professional advice on your circumstances.”

Stay compliant with Superannuation Guarantee (SG) rate increases

Superannuation Guarantee rises to 11.5%

Superannuation Guarantee rate is the minimum percentage of an employee’s earnings that an employer contributes to their superannuation fund account. An employer must pay super at least four times a year, which is every quarter.

The Superannuation Guarantee (SG) rate is currently at 11.5% and will increase to reach 12% by 1 July 2025.

Another gentle reminder: Whilst Superannuation Guarantee is part of the National Employment Standards it is a separate piece of legislation from the Fair Work Act 2009 (Cth).

Q: What do these changes to superannuation mean for employers?

Lorna responds:

“From a wage compliance perspective, I would ensure that your payroll system is applying the new 11.5% rate. Most large payroll providers generally will change this rate on their end, but I would always double check because the risks associated with underpayments are too high.

I would also double check your contracts of employment to ensure that you are applying the superannuation increase correctly. Some contracts will quote the superannuation as an addition to the salary base, others will have an all-inclusive rate. If you are unsure on how to apply the increase, please reach out for professional advice.”

Where to next?

Compliance is more crucial than ever for business leaders today. Staying ahead requires a proactive and strategic approach, including regular audits, reviews, and updates to your organisation’s policies and procedures.

Starting August 26, significant changes to the Right to Disconnect and casual employment laws come into effect, placing an even greater obligation on employers and HR.

Our HR experts are here to guide you through these changes, ensuring you stay compliant and build a resilient workforce. Partner with us to meet your compliance needs with confidence.

Contact us today to discuss how we can support your HR needs.

Recent articles

![Lee Witherden v DP World Sydney Limited [2025] FWC 294 (2) Workplace policies](https://ihraustralia.com/wp-content/uploads/bb-plugin/cache/Lee-Witherden-v-DP-World-Sydney-Limited-2025-FWC-294-2-1024x539-landscape-dc731230e07743843bfa2c830cc42561-.png)

Smart Workplace Policies, Stronger Cultures: Compliance Made Clear